Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file form 15g kaise bhare?

Form 15G is a declaration to be filled and submitted by an individual who is liable to pay tax on his/her income but the total income is below the taxable limit. It is basically used to claim exemption from TDS (Tax Deducted at Source) on the interest income. Form 15G can be submitted by an individual, HUF (Hindu Undivided Family) or a partnership firm (not being Limited Liability Partnership firm).

To fill form 15G, the individual or entity must ensure that the following criteria are met:

1. The individual/entity should be a resident Indian.

2. The age of the individual should be below 60 years (for senior citizens, the age limit is above 60 years).

3. The total income of the individual/entity should be below the taxable limit as per the Income Tax Act.

4. The income should only be from interest from Fixed Deposits, Savings Account, Post Office, etc.

5. The estimated tax on total income should be Nil.

Once the criteria are met, the individual/entity can fill the form 15G and submit it to the bank along with the PAN card.

What is the purpose of form 15g kaise bhare?

Form 15G and 15H are forms that are used by individuals to declare that their income does not exceed the minimum threshold set by the Indian Income Tax Act. This form is used by individuals to avoid the deduction of tax at source on interest earned by them in a financial year. It is important to fill in and submit Form 15G/H only if the individual’s income is below the taxable limit. The form should be submitted to the bank or other financial institution from which the interest is earned.

When is the deadline to file form 15g kaise bhare in 2023?

The deadline to file Form 15g in 2023 is 31st March 2023.

What is form 15g kaise bhare?

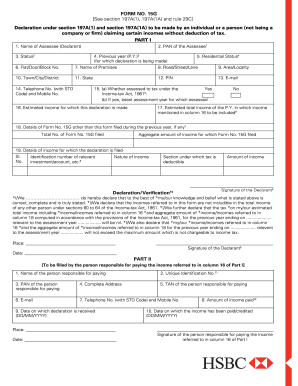

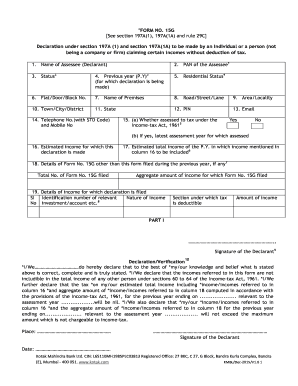

Form 15G is a declaration under section 197A(1) and section 197A(1A) of the Income Tax Act, 1961 to be made by an individual or a person (not being a company or firm) claiming certain receipts without the deduction of tax.

To fill out Form 15G, follow these steps:

1. Download Form 15G from the Income Tax Department's official website or obtain a physical copy from a local tax office.

2. Fill in your personal details such as name, address, PAN (Permanent Account Number), and contact information.

3. Provide details of your income, including financial year, estimated total income for which the declaration is being made, and estimated total income of the preceding financial year.

4. Mention the amount of income for which the declaration is being made and the estimated total income for the financial year.

5. Enter details of the previous declaration made during the same financial year, if applicable.

6. Provide information about the previous year in which such declaration was made, including the assessment year and the assessing officer's details.

7. Sign and date the form at the bottom, declaring that the information provided is true and correct.

8. Submit the completed Form 15G to the relevant financial institution or payer, who may require additional documentation for verification purposes. Keep a copy of the form for your records.

Note: It is essential to carefully review the eligibility criteria and consult a tax professional if needed before submitting Form 15G.

How to fill out form 15g kaise bhare?

Form 15G is a self-declaration form for individuals under the Income Tax Act to avoid the deduction of Tax Deducted at Source (TDS) on specific incomes. Here are the steps to fill out Form 15G:

1. Begin by mentioning the relevant Assessment Year (AY) for which you are submitting the form.

2. Provide basic details such as your name (as per PAN card), PAN number, and address.

3. Fill in your status (individual, HUF, etc.) and the applicable section of the Income Tax Act (Section 197A) under which you are eligible for non-deduction of TDS.

4. Mention the previous year's return filing details, i.e., the previous financial year in which you filed your return of income under the Income Tax Act.

5. Fill in your estimated total income for the current year, including income from all sources.

6. Mention the estimated total income from which TDS should not be deducted under the provisions of Section 197A.

7. Provide details of the nature and the approximate amount(s) of the income for which you are submitting Form 15G to avoid TDS.

8. Declare that the information provided by you is true and correct to the best of your knowledge and belief.

9. Sign and date the form at the bottom.

Make sure to verify all the details filled in the form before submitting it to the appropriate entity, such as a bank or any other income-crediting institution. It is advisable to consult a tax advisor or refer to the official guidelines provided by the Income Tax Department for accurate information and the most updated version of the form.

What information must be reported on form 15g kaise bhare?

Form 15G is a declaration form that individuals can submit to the income tax department to avoid the deduction of tax at source (TDS) on certain types of income. When filling out this form, the following information must be reported:

1. Personal details: Name, address, PAN (Permanent Account Number), and contact details (phone number and email address).

2. Financial year: Mention the relevant financial year for which the declaration is being made.

3. Previous year’s income details: Provide details of income earned during the previous financial year for which the declaration is being made, such as interest income, dividend income, etc.

4. Nature and amount of income: Specify the type of income and the amount for which TDS deduction is sought to be avoided. This could include interest income from fixed deposits, recurring deposits, savings accounts, etc., as well as income from corporate bonds, government bonds, etc.

5. Reasons for claiming exemption: Briefly mention the reasons for seeking exemption from TDS deduction. For instance, if the total income for the financial year is below the taxable limit, the individual can claim exemption from TDS deduction.

6. Declaration: Sign and date the form, declaring that the information provided is true and correct.

It is important to note that form 15G is applicable to individuals below a certain age threshold and certain total income limits, which may vary from year to year. Therefore, it is advisable to consult the latest guidelines and requirements before filling out Form 15G.

What is the penalty for the late filing of form 15g kaise bhare?

Form 15G is an Indian income tax form that can be submitted by individuals to avoid the deduction of tax at source (TDS) on certain kinds of income. If the form is not filed on time, the penalty for late filing can vary.

As of the current information available, if Form 15G is not filed on time, it may result in the deduction of TDS by the payer. In such cases, the taxpayer can claim a refund while filing their income tax return. However, late filing of Form 15G does not generally attract any specific penalties or fines.

It is important to note that tax laws and regulations are subject to change, so it is always recommended to consult a qualified tax professional or refer to the official tax guidelines issued by the Income Tax Department of India for the most accurate and up-to-date information.

How can I modify form 15g download without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like pf form 15g download, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I complete form 15g for pf withdrawal download online?

Easy online 15 g form download completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

Can I sign the pf form 15g download pdf electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your form 15g download pdf and you'll be done in minutes.